Chile mulls scrapping copper funding for military

Codelco chairman, chairman Oscar Landerretche. (Image courtesy of University of Chile)

Codelco, Chile's state-owned copper miner and the world's largest producer of the metal, should soon review its investment plans in light of historic low prices, chairman Oscar Landerretche has said.

In an interview with local news site El D?-namo (in Spanish) last week, the economist said the first step should be scrapping the country's Copper Law, legislation dating back to 1958 that was revisited by former president, dictator Augusto Pinochet. Under that set of rules, Chile's Armed Forces receive 10% of Codelco's annual export revenue.

"Having the country's military needs tied to copper prices makes no sense (...) We must abolish such law and instead give the Armed Forces funding mechanisms fit for the way they work," said Landerretche, who holds a Ph.D. in economics from The Massachusetts Institute of Technology (MIT).

According to official data, in the past 15 years Codelco has injected US$13.4 billion into the country's Armed Forces coffers.

The army, however, has hardly touched its treasure chest, claims Chile's Defense & Military blog. "Weapons acquisitions have been modest, while some key programs (such as helicopters for the Air Force and armour for the Marines) continue to be pushed back."

Two previous governments have tried and failed to eliminate the controversial law, but Michelle Bachelet's administration is once again working on a reform. This time, rather than eliminating the ruling, the government is trying to make Codelco's contribution flexible and based on a number of variables, such as the period's copper prices and the final destination of such funds.

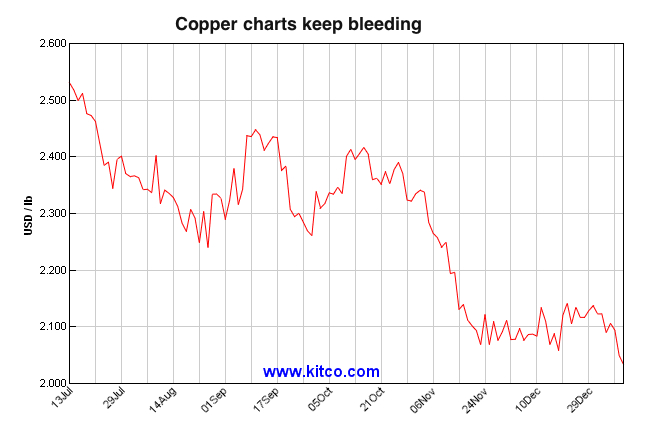

Chart courtesy of Kitco Metals.