Can Gold Retain Its Safe-Haven Status?

As financial market volatility subsides, many think gold will suffer.

Even as confidence returns, however, gold can still remain buoyant.

Concerns over the global outlook will keep gold's fear factor intact.

A question being asked by participants as global markets rebound is whether the gold price can maintain its upward trend? That gold benefited from the extreme financial market volatility late last year can't be denied. So with volatility on the wane, many wonder if gold's number is up. In today's report we'll examine the factors which weigh in favor of gold continuing to trend higher in the coming months in spite of a declining fear factor.

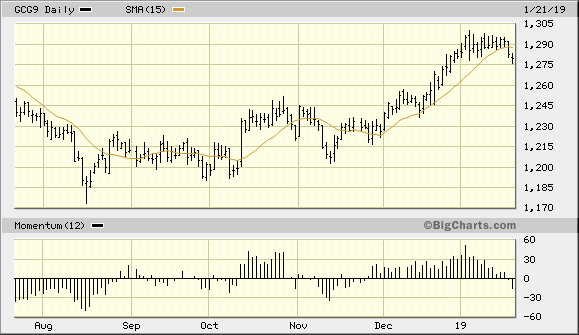

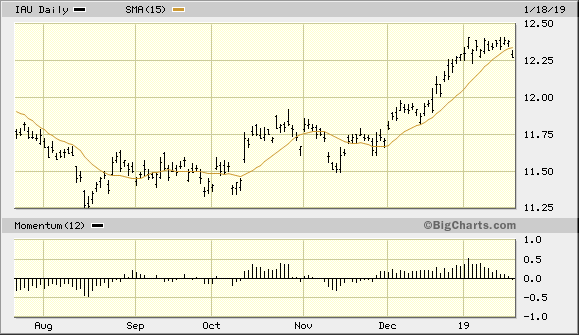

The gold price stumbled last week and finished Friday's session below its 15-day moving average. This marked the first time since November that the metal's price fell below this key immediate-term trend line. Since gold was below the 15-day MA on a weekly closing basis, I regard this as a breach of the immediate-term (1-4 week) upward trend based on the rules of my technical trading discipline. However, as we've discussed in recent reports I'm willing to give gold the benefit of the doubt and retain our trading position in the gold ETF as long as the $1,275 level isn't violated in the February gold futures market and the $12.25 level in the iShares Gold Trust (IAU). I'll have more to say about this later in this report.

Source: BigCharts

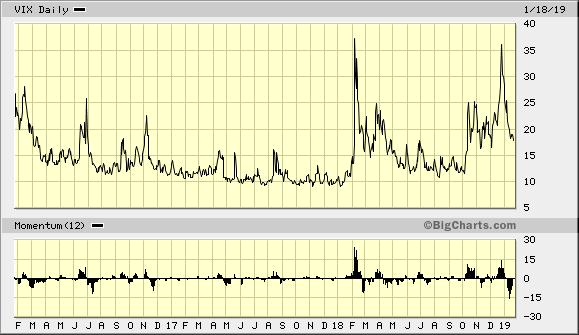

One of the signs that investors are no longer panicky over the short-term financial market outlook is the CBOE Volatility Index (VIX), which is Wall Street's favorite fear gauge. The VIX chart below shows that the December panic in the equity market was accompanied by a sharp rise in the level of fear among participants. It was in fact the second highest fear spike of 2018 as well as one of the highest VIX levels of the last four years. This manifestation of fear and uncertainty was hugely beneficial for the gold price, which had its most impressive rally of 2018 during December.

Source: BigCharts

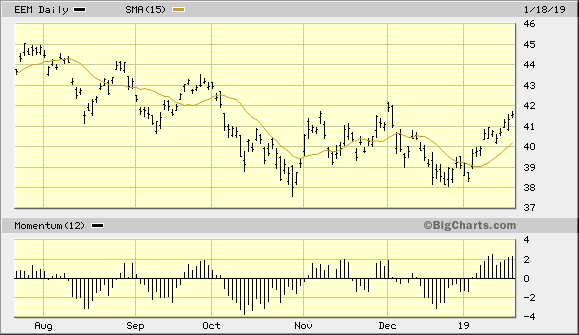

Another potential development which could be interpreted as being detrimental to gold's safe-haven status is the improvement in the stock markets of emerging market (NYSE:EM) countries. My favorite surrogate for the aggregate performance of EM stocks is the iShares MSCI Emerging Markets ETF (EEM). As you can see here, EEM has established what many technicians refer to as a "double bottom" between October and December. Since then EEM has confirmed an immediate-term bullish signal by trending above its rising 15-day moving average.

Source: BigCharts

Further, a close decisively above the 42.00 level in the EEM would confirm a positive shift in the intermediate-term (3-9 month) direction of the emerging market stocks, for this would result in a series of higher highs and higher lows over a four-month period. What has this to do with the price of gold, you ask? Everything, for gold's prospects began improving last August around the time that weakness in the emerging markets was becoming a major concern. If the EM stocks continue to improve from here, it will mean that investor confidence in the global outlook is improving which in turn could undermine gold's safe-haven status on at least a temporary basis.

Should gold investors therefore fear a diminution of global market volatility? As I've argued since late last year, even if global equity markets continue to rebounds in the coming weeks we should see continued buoyancy in the gold price. This is based on the observation that in past instances when stocks rebounded after a steep plunge, the gold price usually benefited from residual safety-related concerns for at least several months after the decline. While fear and volatility tend to fade quickly, investors have long memories and typically remain apprehensive about the intermediate-to-longer-term financial market outlook well after stock market lows have been established.

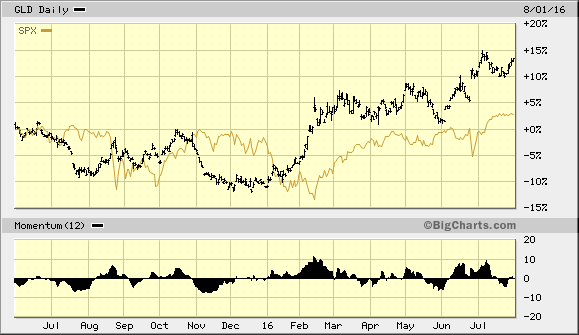

For an example of this phenomenon, consider that during the stock market sell-off of late 2015/early 2016, the gold price not only outperformed the S&P 500 Index (SPX) on a relative basis but also continued rising for many months after the financial market established a bottom in February 2016. For evidence I offer the following graph which compares the performance of the SPX interposed with that of the SPDR Gold Shares ETF (GLD) during 2015 and 2016.

Source: BigCharts

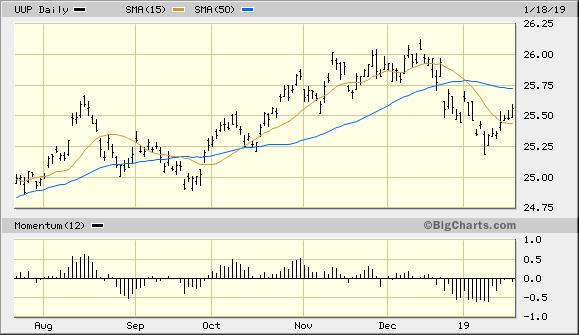

Returning to the short-term outlook, one of the most recent headwinds gold has encountered is last week's rally in the U.S. dollar. While this rally may be regarded as a temporary relief rally, the fact that the dollar finished last week significantly above its 15-day moving average is a concern. More importantly, however, is that the dollar index remains below the more technically (and psychologically) significant 50-day trend line. Shown below is the Invesco DB U.S. Dollar Index Bullish Fund (UUP), my preferred dollar proxy, in relation to both its 15-day and 50-day MAs. It's imperative that the dollar ETF remain under the 50-day MA in order for gold to maintain its overall upside bias. With the dollar remaining under the 50-day MA, gold's currency component will remain strong enough to give the gold bulls the advantage.

Source: BigCharts

Let's now take a look at my favorite gold trading vehicle, namely the iShares Gold Trust (IAU). In recent reports we discussed the increased possibility for a temporary dip in the IAU price. IAU dipped late last week and finished the Jan. 18 session under its 15-day MA, which was the first time the immediate-term trend line was violated since November. However, even if IAU continues to lag in the next several days the gold ETF should continue to benefit in the weeks and months to come from the residual worries over the global market outlook as mentioned above. Moreover, IAU's pullback should be short-lived as long as the dollar index (DXY) remains under its 50-day moving average as also previously mentioned.

Source: BigCharts

On a strategic note, traders should remain long the iShares Gold Trust after recently taking some profit. I also recommend raising the stop loss for the remainder of this trading position to slightly under the $12.25 level on an intraday basis. A violation of $12.25 in the IAU would mean that price has fallen under the technically significant 15-day moving average, in turn signaling a shift in the immediate-term trend.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts