Why the lithium bears are wrong

Economics has been called "the dismal science" for its conclusions which often suggest miserable outcomes for humanity. The saying was born in the 19th century by Scottish writer and philosopher Thomas Carlyle, who was referring to economist Thomas Malthus. Malthus famously calculated that humanity was trapped in a world where population growth would outstrip resources and lead to widespread misery including starvation - a condition known as "The Malthusian dilemma."

Economics is dismal for another reason: it often fails to make accurate predictions.

We see this in the monthly US employment figures which are usually wrong, and in the copper supply projections trotted out by commodities analysts. Every year these analysts dutifully tally up the predicted market supply tonnage based on output targets from the major producers, and almost every year they turn out to be wrong. Why? Because these so-called experts failed to account for the gaps in output that occur due to strikes, extreme weather, bans on concentrate shipments, or any other reason why a mine closes temporarily due to "force majeure".

Now the same thing is happening with lithium, with two recent reports coming up with predictions of a slide in lithium prices due to a glut of new supply overwhelmingly the tiny (by mining's standards) lithium market.What is puzzling is that both of these reports either gloss over or fail to adequately break down the demand side of the lithium market - something we at Ahead of the Herd did some time ago in a separate article. The conclusion we came to was that lithium demand is skyrocketing, and will continue to do so in coming years, due to the irreversible trend of moving from internal combustion engine-powered vehicles to electric vehicles. The trend is particularly evident in Asia. China is the largest EV market by volume, while Japan is number three behind the US. India is also aggressively ramping up EV targets. Of course we've seen the demand scenario play out through lithium prices, which have doubled in the last two years and are current trading at around $23,000 a tonne for battery-grade lithium carbonate. Still, the lithium bears are coming out from hibernation, and lithium stocks have been taking it on the chin. This article will show why they're wrong.

The lithium bears

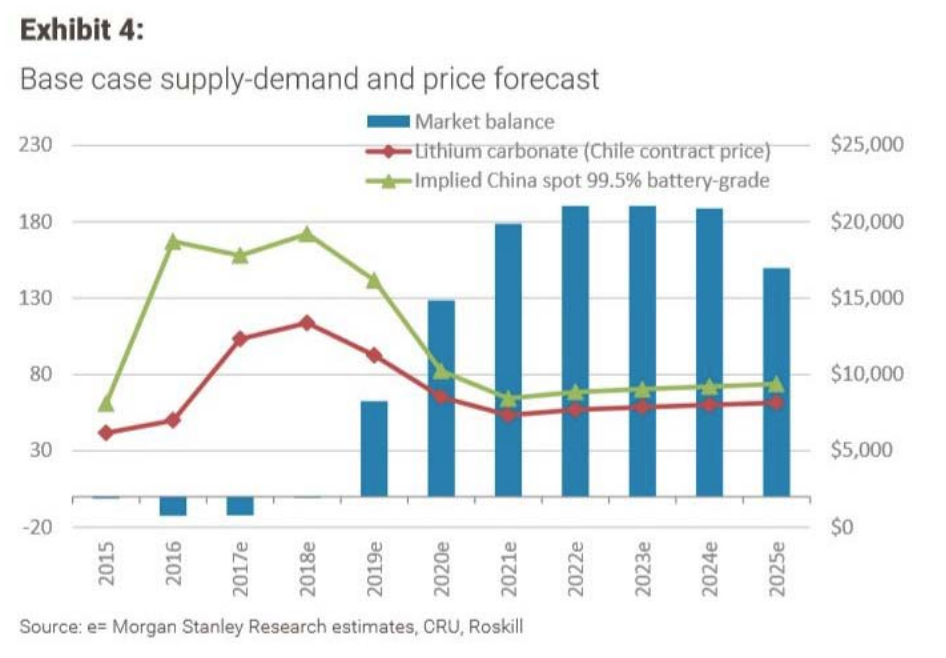

In February investment bank Morgan Stanley was first out of the gate with a damning report on lithium; its research team concluded that an avalanche of lithium was in the works and would put the roughly 200,000 tonnes per year lithium market into surplus. The glut would mean a fall to around US$13,000 a ton in 2018, before halving to $7,000 by 2021.

"A host of lithium projects and expansion plans - including increased production by low-cost Chile brine operator SQM - threatens to add 500 kilotonnes per annum to global lithium raw material supply by 2025, swamping forecast demand growth," Morgan Stanley said.

The main reason for Morgan Stanley's argument for oversupply was the recent government approval in Chile for mine expansions which would "open up the floodgates" to new lithium product. That is referring to a deal struck in January between Chilean development agency Corfu and SQM, Chile's largest lithium producer, over lithium royalties in the Salar to Atacama, one of the largest and highest-grade lithium deposits in the world. The deal frees SQM to boost its production quota in exchange for higher royalty rates equivalent to those paid by competitor Albemarle. It also permits SQM to work with state copper miner Codelco to start developing the Maricunga lithium deposit - the second largest lithium-bearing salt brine deposit in Chile. In all the agreement allows SQM to produce up to 216,000 tonnes of lithium carbonate a year from the Salar de Atacama. Lithium supply could also increase due to the election of a new president in Chile, Sebastian Pi??era, whose National Renewal Party is open to revisiting a law prohibiting lithium production above 80,000 tonnes.

The bank put out a base-case supply-demand and price forecast leading up to 2025, indicating that lithium prices in China and Chile would trend below the market-equilibrium price for the next seven years. Curiously though, the report skewed heavily towards supply with little to no mention of demand.

Morgan Stanley also noted that brine production in Chile has been constrained due to high amounts of magnesium, an impurity in the metallurgical process, but "this is evolving" said the bank, without an explanation how.

Other criticisms levelled at the report:?EUR? It makes no mention of the fact that the new royalty rates on SQM are prohibitive and may impede production.?EUR? The report says new production from brines in Chile and Argentina will be low-cost (under $5,000 a ton), suggesting a pulling away of demand from supply. In fact the lithium market is tight, even with new supplies coming online. According to the USGS lithium supply in 2017 was 236,000 tonnes while demand was 228,000 tonnes. Demand forecasts are expected to increase by 2025 according to thethree major producers, Albemarle, SQM and FMC, who will be pressured to produce enough to meet demand.?EUR? The report states that "A bottleneck in conversion capability will keep a lid on realised carbonate production from hard rock mines in the near term - but this is expanding too." Presumably referring to theability of a miner to convert raw lithium into battery-grade lithium carbonate - this statement is never explained, leaving the reader to wonder how hard rock lithium miners are bettering their metallurgy. Lithium is extremely difficult to process from pegamites and there is currently only one mine doing it - Greenbushes in Australia.

The next lithium bear to wake up was commodities researcher Wood Mackenzie, which forecast a rout in lithium and cobalt - both key ingredients in EV batteries. While Woodmac at least didn't lowball demand growth - expecting it to grow from 233 kilo-tonnes lithium carbonate equivalent (LCE) in 2017 to 330kt in 2020 and 405kt in 2022 - it too forecast an imminent tsunami of lithium supply. Quoting from the report: ... the supply response is under way. Yet it will take some time for this new capacity to materialise as battery-grade chemicals. As such, we expect relatively high price levels to be maintained over 2018. However, for 2019 and beyond, supply will start to outpace demand more aggressively and price levels will decline in turn. - Wood Mackenzie

The London-based firm thus predicts prices will average $13,000 per tonne this year, slip to $9,000 by 2019, and keep dropping to $6,500 in 2022.

Not so easy to make lithium

What the bears seem to have in common is the belief that a rush of new lithium supply will soon hit the market, but what the analysts don't realize, or maybe for their own reasons neglect to mention, is that a lot of these mines will fail to deliver.

There are two primary means of extracting lithium: from brines in evaporated salt lakes known as salars, and hard rock mining, where the lithium is mined from granite pegamite orebodies containing spodumene, apatite, lepidolite, tourmaline and amblygonite.

Many junior exploration companies chasing lithium projects are not cognizant of the economic and technical challenges - no brine mining projects and even fewer hard rock projects have been put into production forthe last two decades and when done so it's been by the major lithium producers in just four countries - Chile, Argentina, China and Australia. This exposes something in the industry no one talks about - a lack of skilledpersonnel to get involved with mineralogy/metallurgy and the engineering side of production.

A major factor affecting capital costs for lithium brines is the net evaporation rate - this determines the area of the evaporation ponds necessary to increase the grade of the plant feed. These evaporation ponds can be a major capital cost. Potassium, boron, potash and other minerals are often harvested from early ponds, while later ponds have higher concentrations of lithium. The lithium-pregnant solution is then pumped to an extraction plantwhere impurities like boron and magnesium are removed.

Hard rock lithium miners have large problems facing them when competing with brine economics - firstly most have large capital costs for start up and secondly their production cost is roughly twice what it is for the brine exploitation process.

Lithium products derived from brine operations can be used directly in endmarkets, but hard-rock lithium concentrates need to be further refined before they can be used in value-added applications like lithium-ion batteries.

Extracting lithium from spodumene requires a whole range of hydrometallurgical processes. The ore is first crushed and heated in a kiln to create a spodumene concentrate, which is then cooled and milled into a fine powder. It is then mixed with sulfuric acid and roasted again, before waste is separated from the concentrated liquor, and magnesium and calcium are precipitated out. Finally soda ash and lithium carbonate is crystallized, heated, filtered, and dried, creating 99% lithium carbonate. Lithium carbonate is turned into metal in an electrolytic cell using lithium chloride.

Demand "going through the roof"

We've been been crunching the supply and demand numbers for almost a decade - at least since President Obama put aside nearly $2 billion in 2009 to support research on hybrid and electric vehicles and their battery components. What we know is this:

Asia and particularly China are looking to lock up lithium supply, and are years ahead of North America in terms of EV penetration and battery supply chains. Last year China sold about 700,000 electric cars, 200,000 more than 2016. Government subsidies to EVs have been reduced by 20%. The Middle Kingdom sees EVs as the key to unlocking the pollution dilemma that has plagued its car-choked cities. China represents over a quarter of the global EV market, and will own 40% by 2040 according to the International Energy Agency (IEA).

The country has signed lithium offtake agreements with mines in Australia, Canada and Africa, and despite Tianqui Lithium - which owns 51% of Talison's Greenbushes mine in Australia, the largest hard rock lithium mine in the world - being recently denied a 32% ownership stake in SQM, China isn't giving up. Other Asian companies, such as Japan's Panasonic and Korean conglomerate Samsung, are also looking to ink deals in the lithium triangle of Chile, Argentina and Bolivia.

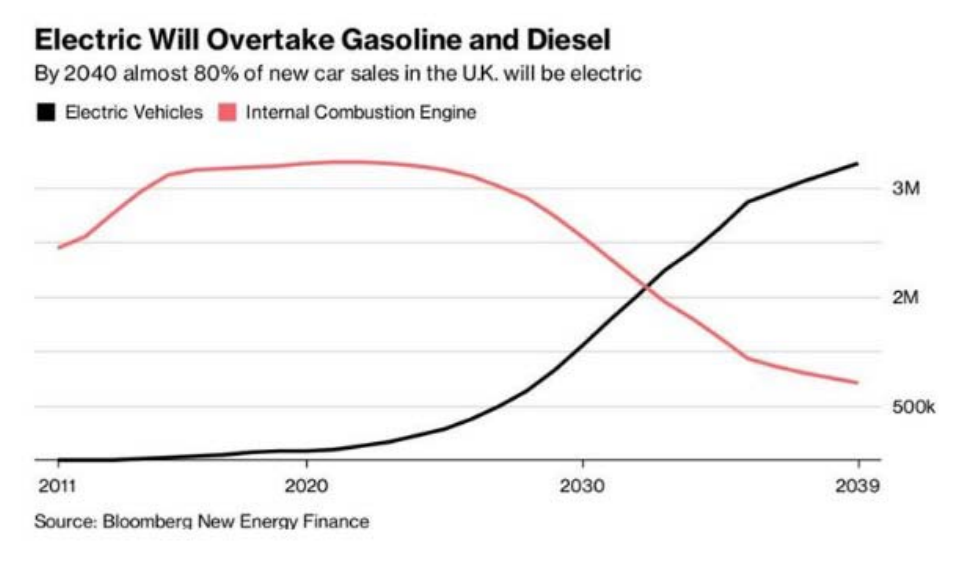

China and India are both going to 100% electric vehicles. Every major car manufacturer has electric models. Volvo has even promised to phase out internal combustion engines (ICE) from 2019.

France has promised to end the sale of gasoline and diesel vehicles by 2040; the UK quickly followed suit. Almost a third of cars sold in Norway in 2016 were electric and Germany could outpace its neighbors as Volkswagen aims to become a leader in both EVs and automated vehicles.

EVs surpassed 2 million units in 2016 and Bloomberg New Energy Finance predicts they will make up an astounding 54% of new car sales by 2040.

In 2016, Chinese carmakers sold 28.03 million cars. If China follows through on its promise to go 100% electric that's a minimum 28.03 million lithiumion battery packs for EV's per year.

Add in the UK's 2.7 million car sales in 2016 and France's 2 million car sales in 2016.

That's 32.73 million electric vehicles all requiring lithium-ion battery packs, without counting electric buses (a big deal in China, and going to be in India as well) or annual growth rates in auto sales. One Tesla car battery uses 45 kg or 100 pounds of lithium carbonate.

Despite recent issues with its Model 3, Tesla aims to produce 6,000 cars a week, or 312,000 a year. It plan to ramp that up to 1,000,000 cars by 2020. New models would include the Model Y SUV, a pick-up truck, and a semitruck, all electric. A recent news report states the problem with the Model 3, and the obstacle to putting more cars on the road, is a bottleneck in battery production.

A million electric cars produced in North America means 45,454,000 kg/ 100,000,000 pounds or 45,454 tonnes /50,000 tons of lithium carbonate equivalent (LCE) has to be mined just for Tesla's North American electric vehicle production - and Tesla has promised to source North American lithium. Elon Musk, Tesla's CEO, also has plans to build four more Gigafactories other than the one currently being built in Nevada. And it's not just about the US. China is also building lithium-ion megafactories, and by 2020 these are expected to grow global production capacity by six times.

Think about those global 32,730,000 lithium battery packs.

If each used the same amount of lithium carbonate as Tesla's electric vehicles, that's 1.487 billion kilograms/ 3.273 billion pounds or 1,487,727 tonnes /1,636,500 tons of new lithium carbonate demand.

Current annual production of lithium carbonate equivalent (LCE), for all purposes, stands at about 230,000 metric tonnes.

SQM recently predicted that demand will increase from between 600,000 and 800,000 tonnes of LCE over the next 10 years. To meet the need, SQM plans to double capacity from current annual production of 48,000 tonnes to 100,000 by 2019.

The industry agrees that Morgan Stanley is out to lunch on its forecasts.

"I am firmly of the view that everyone, including Morgan Stanley, is grossly underestimating how quickly the market is moving on the demand side," Ken Brinsden, chief executive of Australian lithium miner Pilbara Minerals, said at a mining conference in Florida in February.

"Lithium is coming of age in a big way. It's the core ingredient to 99 percent of electric vehicles and as a result, demand is going through the roof," Simon Moores, managing director at Benchmark Mineral Intelligence, a UKbased battery metals consultancy, told CNBC.

Another key point is that analysts tend to lump all potential lithium production together, including producers, near-term producers, brines, hard rock mines, and lithium sucked from oilfield brines. The forecasts vastly underestimate the difficulty in extracting lithium from spent oilfields, for example. Some of these wells are up to four kilometers deep, the brine needs to be pumped and trucked to a storage site, then the lithium has to be separated from all the other impurities which could include uranium, thorium, magnesium and potash. It's neither an easy nor a cheap process and no company has yet been able to do it on a commercial scale.

Read the full newsletter here.