Gold Mining Bull: Top News For June 2018

Nevsun reports a large copper/gold resource at Timok Lower Zone.

Yamana declares commercial production at Cerro Moro.

Wheaton lands a cobalt stream.

A look at the top news in the gold mining sector for June 2018.

Here's a monthly recap of the top news in the gold mining sector, including acquisitions and takeover announcements, financial results and other relevant updates, to keep readers up-to-date on news in the sector. Here's my update for May, in case you missed it.

This was a pretty interesting month for the gold mining sector. In June, we saw M&A pick up a bit, despite gold prices stuck in the summer doldrums.

(Credit: StockCharts.com)

(Credit: StockCharts.com)

June was a particularly active month for the royalty and streaming sector in particular, with two major new deals announced and the release of a technical study on a major project. It looks like the royalty companies are taking advantage of the weakness in gold prices, as this has been the best time to complete deals.

Here's a recap of the top news from the gold mining sector for June 2018.

10. Royal Gold Buys Royalty on Mara Rosa project

Royal Gold (RGLD) has agreed to pay $10.8 million to buy a 1.75% NSR on Amarillo Gold's Mara Rosa gold project in Brazil. Mara Rosa contains 1 million ounces in near-surface gold reserves, and a PFS gives the project an after-tax NPV of $223 million (5% discount, $1,300 gold price).

It's a smaller high-risk, high-reward deal for Royal Gold. Amarillo shares are up 29% on Monday, July 2 as of writing.

9. Nevsun Reports First Resource at Timok Lower Zone

Nevsun's (NSU) high-grade Timok Upper Zone project in Serbia is the company's real prized asset, however, the 46%-owned low-grade Lower Zone initial resource also looks promising.

The company says the Lower Zone resource consists of 31.5 billion pounds of copper and 9.6 million ounces of gold, all in inferred resources. A lot more work needs to be done to "prove up" these resources, and there's no real sense yet if this will be a profitable deposit to mine. However, I think it's a good start and gives the company a bit more optionality on copper and gold prices.

Note: Freeport McMoran currently owns 39.6%, but will own 54% of the Lower Zone upon completion of a feasibility study on either the Upper or Lower Zone.

Also take note that Rio Tinto is reportedly on the hunt for copper acquisitions, and Nevsun was listed as a potentially attractive target in this article. Any offer would have to top Euro Sun and Lundin's previous offer.

8. Yamana Declares Commercial Production at Cerro Moro

Yamana Gold (AUY) has declared commercial production at the high-grade gold/silver mine in Argentina, just a month after achieving initial production. The project was brought online on-time and on-budget. Cerro Moro is expected to produce 85,000 ounces of gold and 3.75 million ounces of silver this year, with a medium-term target of 130,000 ounces of gold and 7 million ounces of silver.

Also count this as good news for Sandstorm Gold (SAND), which owns a silver stream on 20% of the silver produce at the mine until 7 million ounces have been delivered, and then a 9% silver stream thereafter (at 30% spot price of silver).

7. Semafo Pours First Gold at Boungou Mine

Semafo (OTCPK:SEMFF) has announced first gold pour at its Boungou mine in Burkina Faso, and it is slightly ahead of its original schedule.

This is a key asset for Semafo, as the mine should add 204,000 ounces of annual gold production over the first five years at $516/AISC. Semafo is also forecasting a total of $1.3 billion in operating cash flow from 2018 - 2023, using $1,300 gold prices.

6. Kirkland Lake Pursues Arbitration Against Centerra Over Fosterville Royalty

In an interesting development, Kirkland Lake Gold (KL) announced that it is pursuing arbitration against Centerra Gold (OTCPK:CAGDF) over the sale of Centerra's 2% Fosterville royalty. Centerra had sold its royalty portfolio, including the Fosterville royalty, to Triple Flag Mining Finance on June 27.

However, Kirkland Lake owns a right of first offer or right of first refusal on the asset, and was not afforded the opportunity to exercise its right, according to the news release. Buying the royalty would lower Kirkland Lake's costs and improve profitability on Fosterville. It's a development worth monitoring for shareholders, as well as anyone interesting in the royalty business.

5. Excelsior Mining Lands Permits for Gunnison Mine

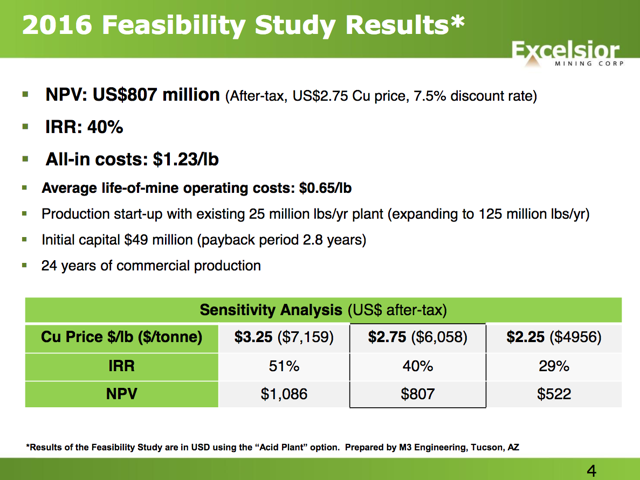

Excelsior announced it has received its Federal EPA operating permit for the Gunnison mine in Arizona. The permit allows Excelsior to produce up to 125 million pounds of copper annually.

(Credit: Excelsior Mining Presentation)

Gunnison is set to become the next low-cost copper mine. A feasibility study on Gunnison gave the project a net present value of $807 million and an IRR of 40%, using a conservative copper price of $2.75/lb and a 7.5% discount rate. The project is still profitable at $2.25/lb copper, with a NPV of $522 million.

4. Bonterra Resources to Buy Metanor

Bonterra (OTCQX:BONXF) will combine with Metanor (OTCPK:MEAOF) to consolidate the Urban Barry camp in Canada. It is buying out the Canadian miner at a price of C$.73, a 40% premium.

The pro-forma company will have a producing gold mine in Bachelor, plus a high-grade gold deposit in Gladiator and the Barry development project. The company will also be flush with C$32 million in cash on hand.

This is another positive development for Sandstorm Gold, which owns a 4.9% NSR royalty on Bachelor Lake, plus a 3.9% - 4.9% NSR on Barry.

3. Osisko Buys Silver Stream From Falco Resources

Osisko Gold Royalties (OR) has made a significant investment in Falco Resources, purchasing a silver stream on Falco's Horne 5 project. For C$180 million, Osisko will get the right to purchase 100% of the silver produced at an ongoing price equal to 20% the spot price of silver (up to $6/oz).

The silver stream deal was covered in more detail for subscribers.

2. Sandstorm Gold Hod Maden PFS Results: Value Confirmed

Sandstorm Gold reported on the results of its 30%-owned Hod Maden project in Turkey. The highlights include: Average annual production of approximately 266,000 gold equivalent (AuEq) ounces at a head grade of 11.9 g/t AuEq (8.9 g/t gold), with a mine life of 11 years, with 79,800 gold equivalent ounces attributable to Sandstorm annually.

Hod Maden has an after-tax NPV of $1.1 billion in this study; that means Sandstorm's 30% share is worth $330 million currently, which is positive given Sandstorm only paid $175 million for its 30% interest in the asset.

Overall, I felt this was a strong report for Sandstorm. Coverage of the PFS was provided for subscribers.

1. Wheaton Precious Metals Buys Cobalt Stream

The top news of the month goes to Wheaton Precious Metals (NYSE:WPM), which purchased a cobalt stream on Vale's Voisey's Bay Mine in Canada for $390 million.

Production on the stream will start in 2021, which coincides with the ramp up in underground production at Voisey's Bay. Wheaton is essentially betting on cobalt prices, which are driven mainly by electric vehicle demand. Time will tell whether or not Wheaton's gamble on cobalt will pay off.

Did I miss any top news this past month? Please comment below.

Subscribers to my Marketplace service The Gold Bull Portfolio get to see my portfolio, which provides leverage to the price of gold (GLD) and has outperformed benchmark indexes, such as the VanEck Gold Miners Index (GDX). Sign up now and get a 10% discount on your subscription (for a limited time only).

Disclosure: I am/we are long VARIOUS STOCKS MENTIONED.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Follow Gold Mining Bull and get email alerts