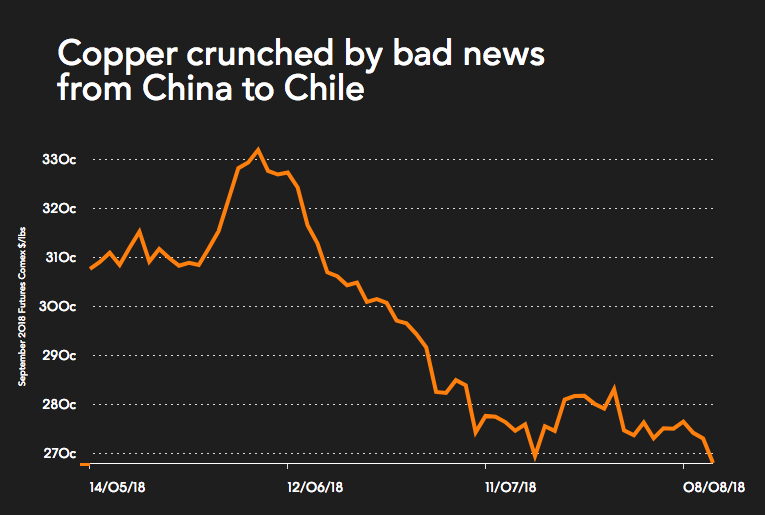

Copper price falls as China investment grows at slowest pace on record

Source: Bloomberg

Copper continued to decline on Tuesday to touch its lowest in 13 months after disappointing economic numbers from top consumer China and the possibility of an averted strike at the world's biggest mine conspired to push the price of the orange metal lower.

Copper fell 2% to $2.6770 a pound or $5,902 a tonne on the Comex market in New York bringing its losses over just two months of trading to nearly 20% or $1,450 a tonne.

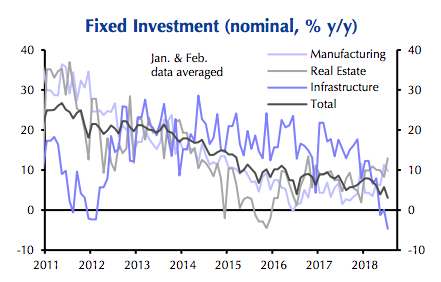

China consumes nearly half the world's copper and data released today showed fixed investment in manufacturing, real estate and infrastructure for the first seven months came in well below expectations at 5.5% year on year.

In a research note, Capital Economics says on a monthly basis this means that growth recorded its slowest pace on record declining from 5.7% in June to 3% last month.

Sources: CEIC, Capital Economics

The independent researcher says there are further downside risks to the Chinese economy in the coming months because credit growth is still slowing:

The recent strength of exports is also unlikely to be sustained in the face of expanding tariffs and cooling global growth.

Admittedly, infrastructure spending may soon bottom out given the recent shift toward a looser fiscal stance and monetary easing should eventually drive a turnaround in credit growth.

However, these are unlikely to put a floor beneath economic growth until the middle of next year.

Safer supply

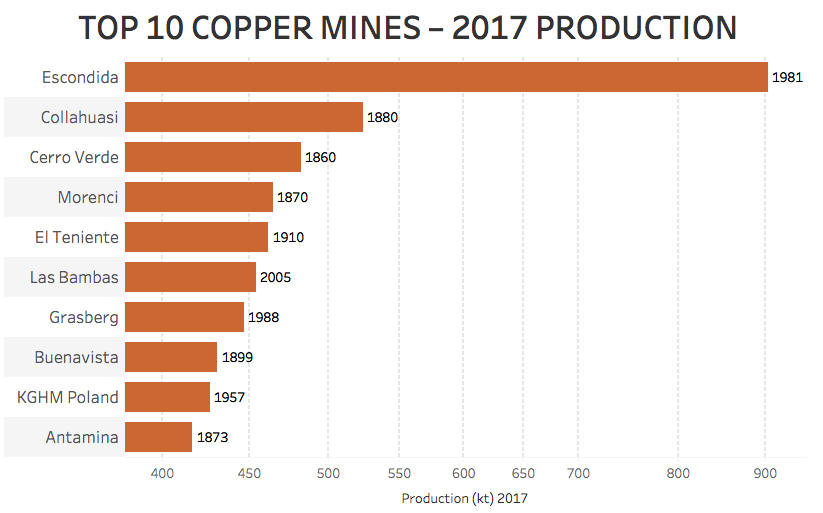

Workers at the Escondida mine in Chile, the only copper operation with output of over one million tonnes per year, called off a strike set to kick off on Tuesday, extending negotiations with part-owner operator BHP.

The extension follows five days of closely-watched talks over pay at the mine that have been mediated by the government of Chilean President Sebastian Pinera.

"We've managed to clear up the points that had stalled the negotiation. But there are still some important points to be resolved," the union said in a short statement, without giving further detail.

Anglo-Australian mining giant BHP also said in a statement that it had agreed to extend talks with the union through Tuesday.

In its last known offer more than two weeks ago, BHP offered a signing bonus of about $18,000, plus separate bonuses intended to buy out clauses in a previous contract that allowed for housing benefits and a loan program.

The total package was valued at $27,700, including a salary increase of 1.5 percent.

But the union had asked for a signing bonus almost double that offered by the company, and had requested a salary increase of 5 percent, leaving a wide gap between the two sides.

The union said it would have to take any potential deal on Tuesday back to its members for approval.

A 44-day strike in February-March last year crippled production at Escondida, which BHP expects will produce more than 1.2m tonnes in 2018 (up from 925kt last year).

Source: Company reports, MiningIntelligence, Wood Mackenzie. Notes: Annual copper production 2017 except Codelco's El Teniente and KGHM Poland operations = 9 months 2017 annualized. KGHM Poland consists of Rudna, Polkowice-Sieroszowice and Lubin mine complex. Reserves as at end-2017 except KGHM, Codelco mines at end-2016. Grasberg reserves include Block Cave under development and undeveloped Kucing Liar deposits.

(With Reuters)